Intuit QuickBooks Self-Employed: Features & Comparison

QuickBooks Self-Employed is a small business accounting software for self-employed individuals required to file a Schedule C, such as freelancers, real estate agents, Uber drivers, and independent consultants. As of the date this article was published pricing plans start at $10 per month, and you can track all income and expenses, mileage to and from clients, and file your taxes with the QuickBooks Self-Employed TurboTax bundle.

If you’re currently using an Excel spreadsheet or stuffing receipts in a shoebox, it’s worth upgrading to the QuickBooks Self-Employed Tax Bundle. You can scan and categorize expenses from their mobile app easily. You can also pay estimated quarterly taxes and file a federal and state tax return at no additional cost. Save up to 50% for a limited time.

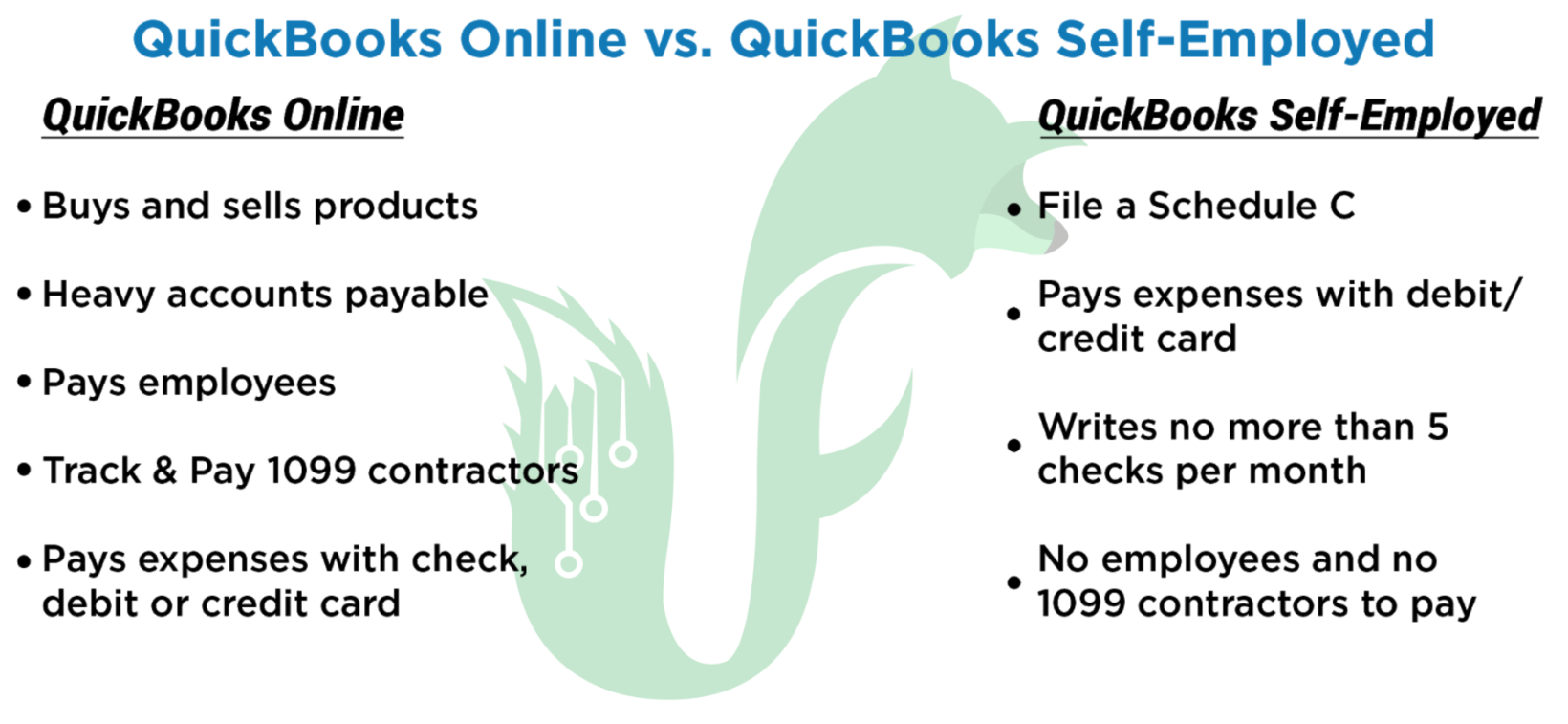

QuickBooks Online vs. QuickBooks Self-Employed

If you are a freelancer or solopreneur who files a Schedule C, then QuickBooks Self-Employed will work for you. Schedule C is a detailed profit and loss report that is submitted with a sole proprietor’s personal income tax form 1040. However, if you are a partnership or a corporation, QuickBooks Online Plus is going to be a better fit for you.

When to Use QuickBooks Self-Employed

If you file a Schedule C, pay expenses with a debit card or credit card, write only a handful of checks each month and have no employees or contractors, QuickBooks Self-Employed is ideal for you. Plus, if you do your own taxes, QuickBooks Self-Employed TurboTax bundle will allow you to transfer your data to TurboTax.

In general, QuickBooks Self-Employed will work for individuals or businesses that meet the following criteria:

• Files a Schedule C with Form 1040.

• ays majority of expenses using a debit card, credit card or cash ― minimal paper checks.

• Writes no more than five checks per month.

• Invoices no more than 10 customers per month.

• Does not have any employees as QuickBooks Self-Employed does not have payroll functionality.

• Does not employ any contractors.

• If you do employ contractors, and they are paid $600 or more in a calendar year, then you will need to complete 1099 reporting. QuickBooks Self-Employed does not support this function.

Get started today with QuickBooks Self-Employed, and you can save up to 50 percent off for the first three months.

When to Use QuickBooks Online

If you file taxes as a partnership, S corporation (S-corp) or C corporation (C-corp), and you need to track inventory, manage accounts payable (A/P), and pay employees or contractors, then QuickBooks Online Plus is going to work best for your business. Plus, you can do budgeting and forecasting in QuickBooks Online and give up to seven users access to your data.

In general, QuickBooks Online will work for individuals or businesses that meet the following criteria:

• Buys and sells products, like a retail store

• Manages heavy A/P

• Has employees who work for you

• Hires 1099 contractors who are paid at least $600 or more within the fiscal year

• If you are leaning towards QuickBooks Online, you will need to choose the right plan for your business. QuickBooks Online has three plans that start at $20 per month: QuickBooks Online Simple Start, Essentials and Plus.

QuickBooks Self-Employed Cost & Pricing

QuickBooks Self-Employed has two pricing plans, a standard plan which starts at $10 per month and the TurboTax bundle plan, which starts at $17 per month. You can keep track of income and expenses, track mileage using the mobile app, and invoice customers with both plans. However, the TurboTax plan exports your data to TurboTax.

The TurboTax Bundle includes the following features that are not offered in the standalone Self-Employed version:

• Export Schedule C data to TurboTax

• One federal and one state tax return filing are included

• Pay quarterly taxes online directly from QuickBooks Self-Employed

QuickBooks Self-Employed was created for freelancers who don’t need all of the bells and whistles included in QuickBooks Online but still need a software program that addresses their basic needs like manage income and expenses, track miles to and from clients, and transfer the data to a tax return easily. While you can’t manage unpaid bills or print checks, it’s still a great program that meets the needs of many freelancers, Uber and Lyft drivers, and part-time property investors.

Intuit QuickBooks Self-Employed Features

QuickBooks Self-Employed will help you organize your income and expenses with all of the many features that are included. Track your mileage, connect your bank card and credit card accounts, separate personal from business expenses, and upload receipts are just a few of the many features you will find in QuickBooks Self-Employed.

Track Your Mileage Automatically

If you drive for business reasons, you can deduct the cost of mileage or actual vehicle expenses. QuickBooks Self-Employed has a mileage tracker app that you can download on your Android or IOS phone, and it will track your start and stop locations for all of your trips automatically.

Below is a screenshot of the QuickBooks Self-Employed mileage tracker app:

QuickBooks Self-Employed mileage tracker app

![]()

Connect Your Bank & Credit Card Accounts

Similar to QuickBooks Online, you can download your bank and credit card transactions directly into your QuickBooks Self-Employed account. From there, you can categorize each transaction to the appropriate account to complete your Schedule C.

Separate Personal Expenses From Business Expenses

It’s easy to separate your business and personal expenses by setting up a category for personal expenses during the bank account setup. Any expense that comes out of your bank account and is not related to your business should be categorized as personal expenses so that it is not included as a tax deduction.

For example, if your rent check is downloaded from your bank into your QuickBooks Self-Employed account, and you do not work from home or claim the home office deduction, this would be considered a personal expense and should be categorized that way.

If you don’t have a separate bank account for your business, you need to set one up. It is not a good idea to commingle personal funds with business funds. If you are ever audited by the IRS, and you do not have separate business checking accounts, I can promise you that it will not go well.

Attach a Receipt to a Transaction

The QuickBooks Self-Employed mobile app for iPhone and Android allows you to take a picture of a receipt and attach it to a transaction directly from your mobile phone. This type of functionality will save you time in the long run and is a valuable feature of QuickBooks Self-Employed.

Create Tax Payment Due Date Reminders

Based on the tax profile that you complete during setup, QuickBooks Self-Employed will project your annual profit, provide you with estimated tax payment recommendations and provide alerts for all tax due dates.

Transfer All Information to Schedule C in TurboTax

With the purchase of a TurboTax Bundle, you get QuickBooks Self-Employed combined with TurboTax Home & Business. This makes it easy to transfer all of your Schedule C information into TurboTax to complete your tax return. If you do your own taxes, this is the plan you should subscribe to because TurboTax will make tax time a breeze by calculating all of the deductions that you qualify for and will lower your tax liability.

File Both Federal & State Taxes

With the purchase of a TurboTax Bundle, QuickBooks Self-Employed includes both a federal and state tax return filing for free. However, the product does not currently handle state quarterly estimates or tax payments.

Run Financial Reports Quickly

There are three reports you can download easily and email to your accountant for tax filing:

• Profit and loss statement

• Tax summary

• Tax detail

• Having the ability to run these reports will give you insight into how profitable your business is as well as provide the details of your estimated tax liability.

Access Real-time Data

On the homepage of QuickBooks Self-Employed, there is a dashboard where you can see the most up-to-date information..

The information you will find on the QuickBooks Self-Employed dashboard is:

• Left menu bar: Navigate to each area of the program using the left menu bar.

• Profit and loss: View total income and expenses in this section for any timeframe you specify, such as this month, last month, this year, or last year.

• Expenses: View your total expenses in this section for the timeframe that you specify, such as this month, last month, this year, or last year.

• Accounts: View the current balance of all bank/credit card accounts connected to QuickBooks Self-Employed.

• Invoices: View current accounts receivable balances in this section.

• Mileage: View the total mileage recorded using the QuickBooks Self-Employed mileage tracker app.

• Estimated taxes: Review the estimated taxes you owe, based on an automatic calculation performed by QuickBooks Self-Employed from the income and expenses you have recorded.

• Go ahead and sign up for a 30-day free trial so you can download the QuickBooks Self-Employed app and start tracking your miles and taking a snapshot of those receipts so they will populate in the program for you automatically. There is no risk — and no credit card required.

Pros and Cons of QuickBooks Self-Employed

There are several pros and cons to using QuickBooks Self-Employed. On the pros side, QuickBooks Self-Employed makes it easy to track mileage and expenses using the mobile app. You can also separate business from personal expenses, which is great if you have not opened a business checking account. On the negative side, you can’t manage your A/P, and you cannot pay employees and contractors in QuickBooks Self-Employed.

Pros of QuickBooks Self-Employed

• Simplifies mileage & expense tracking with a user-friendly app: With the QuickBooks Self-Employed app, you can upload receipts on the go and keep track of your mileage while you’re on the road; which means you no longer have to carry around an envelope with receipts, log your miles in a notebook, and remember to record everything in your accounting system later

• Allows you to keep track & separate business & personal finances in one place: When you use QuickBooks Self-Employed, you have the ability to keep track of both your personal and business income and expenses in one place, which is important for sole proprietors; even though they’re tracked in the same place, it’s easy to keep them separate so you don’t have to worry about commingling funds

Cons of QuickBooks Self-Employed

• Doesn’t allow you to manage A/P: If you have A/P to manage, the QuickBooks Self-Employed isn’t the right option; a better option is QuickBooks Online

• Only works for single-employee companies: When you’re ready to take on your first employee, you’ll need to upgrade to QuickBooks Online; this is because QuickBooks Self-Employed is only meant to help solopreneurs

Frequently Asked Questions (FAQs) About QuickBooks Self-Employed

We have included the most frequently asked questions about QuickBooks Self-Employed in this section. If you don’t see your question, head over to the Fox IT Concepts forum and post your question there. We look forward to answering questions from small business owners like you every day.

Is QuickBooks Good for Self Employed?

QuickBooks Self-Employed was made for self-employed people like freelancers and Uber or Lyft drivers. It allows you to keep track of personal and business expenses, plus it calculates your estimated quarterly taxes. Additionally, with the QuickBooks Self-Employed mobile app, you can track your business mileage easily.

Is QuickBooks Self-Employed Free?

QuickBooks Self-Employed is free for the first 30 days. After 30 days, you will need to sign up for a paid account. You can sign up for the basic QuickBooks Self-Employed account, which starts at $10 per month. Alternatively, if you also want to keep track of your taxes, the TurboTax Bundle account starts at $17 per month.

What’s the Difference Between QuickBooks Self-Employed & QuickBooks Online?

There are several differences between QuickBooks Self-Employed and QuickBooks Online. QuickBooks Self-Employed is ideal for sole proprietors and small business owners who want to keep track of both personal and business expenses. QuickBooks Online is ideal if you are a partnership, S-corp, or C-corp that needs to pay employees, track inventory, and track payments to 1099 contractors.

How Do I Upgrade From QuickBooks Self-Employed to QuickBooks Online?

To upgrade from QuickBooks Self-Employed to QuickBooks Online, you will need to export the data that you need out of QuickBooks Self-Employed manually and import it into QuickBooks Online the same way. Luckily, you can contact the Intuit Support team, and they will assist you with this process at no additional charge.

Bottom Line

If you are a freelancer or solopreneur with no employees or contractors, QuickBooks Self-Employed was made for you. You can sign up for the standard version, and then upgrade to the TurboTax bundle whenever you’re ready.

If you are ready to ditch that Excel spreadsheet and get your income and expenses organized, sign up for a 30-day, risk-free trial of QuickBooks Self-Employed and check it out for yourself.